Ari Takanen - Kielo Growth

- Jari Pakarinen

- Mar 19, 2019

- 2 min read

Ari Takanen tells about his career from university researcher to business builder to startup investor with Kielo Growth.

Usually people come for money but get much more!

Small companies can own small niche sectors of market. Big companies are not interested so small company can own the market in peace.

If you have special skill that no-one else knows - you can profit that. And if there are only few people who have the skill, hire them and you have all the knowledge.

FFF - you don't need prototype, just the idea.

Seed - you need a prototype or really good slide deck to get investor interested.

Round A/B - you have to have product and some user base to get more money for development.

You get paid already of you product, or you get other funding for starting the company. Building product, building user base.

In this case you own the company, and control as long as you are at the stage to get the big money.

No-one will pay you to build only prototypes - so you need to have a business or something running to get loan etc.

High profile investors will grow your company profile and give credibility.

If you make profit, it will be taxed, except you have loan so you can make minor loss and but the money into growth.

VC = venture capital(ist).

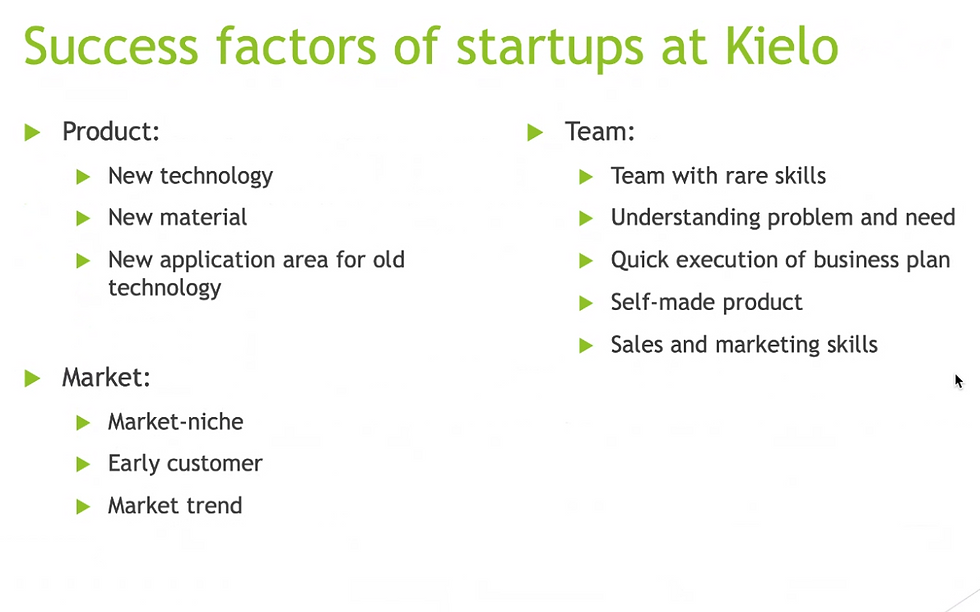

From all this - what is critical - team team team!!! After basic understanding from the investors, they will be interested in TEAM!

After product analysis and team analysis they start looking into markets.

VC's are interested in building the business, not the prototype.

You might lose half of the company for example as shares, if you run long with convertible loan!!! Be carefull with this!

Think about what money you will get or make in the future compared to the financing.

PS = price to sales.

Investors are business people, not inventors- so there is no such thing as smart money, meaning that investors understand your business better than the other investors.

Talk to the investors! So they know you, and they remember you. Learn to know the people who investor talks! Know them, so they know you!

Investors are you you customer, they will not try to make YOU happy, they will try to make their investors happy!!! They control the money, they control your salary!

Last thing you want to do is to sell part of your company.

From questions:

When to actually start the company?

First moment when you start a company is when you sell your first product to customer or when you get public money or investor. If you don't need to start a company don't rush to doing it.

Feedback from the pitch talk.

Automation of elderly peoples homes. safety add on.

Find the easiest customers.

how much it would cost?

Is it safety product, or what else?

In industry - it is cheaper to buy a new one.

if someone will not want to change something permanently - for temperarily.

open platform

Try to find how many people there are who would like to have it. (1/100 compared to 1/1 000 000)

Make cartoon and drawing and get idea of how many people would like it.

To make pitch you need to provide - need - solution - story - business plan.

Comments